Gift Cards

A gift for special

moments in life!

What to do when you have trouble finding a gift for a friend or a family member? Let your loved ones buy what they desire.

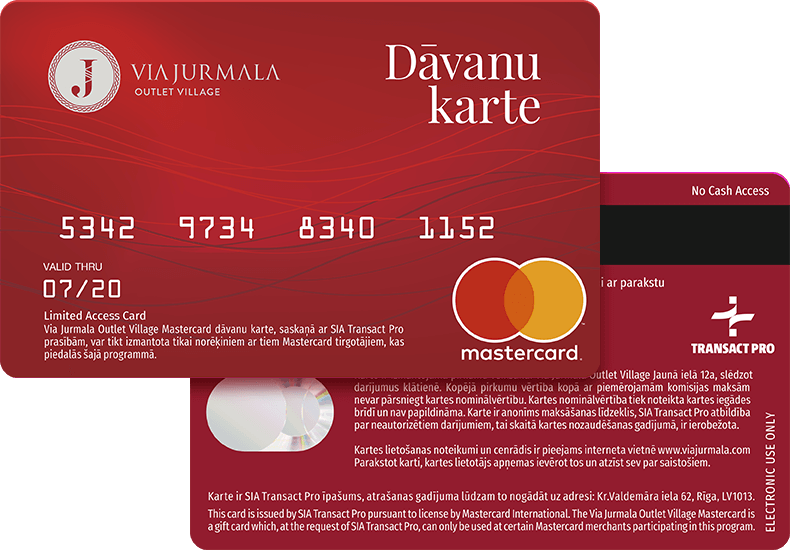

Via Jurmala Outlet Village Gift Card is a great opportunity to please your close ones, friends and colleagues! The owner of the Via Jurmala Outlet Village Gift Card will have the chance to pay in all stores and spend the card’s deposit in parts. You can order a Gift Card at the information desk in Via Jurmala Outlet Village.

Terms of use of the Gift Card

Gift Card and its voucher should be treated as money. Via Jurmala Outlet Village do not take any responsibility for lost gift cards nor redeem the amount stolen.

If the voucher of a gift card is lost the Gift Card can be picked up from Via Jurmala Outlet Village information centre with the buyer or receiver personal ID. If the card has been picked up already no duplicate cards are given nor the amount redeemed.

Terms of use

Valid from 14.12 .2020.

The present Terms define the procedure of use of the electronic gift cards containing the electronic money issued by “Transact Pro” issued by the Limited Liability Company “Transact Pro” in cooperation with “SIA OUTLETICO” The Terms are binding for all the Merchants, Buyers and Users.

Electronic gift cards are issued for Buyers and Users to use them for making settlements for the goods and services available at the Shopping Centre “VIA JURMALA OUTLET VILLAGE” by using the electronic money issued by the Issuer and contained by cards. Gift cards are not intended for withdrawals of cash.

1. DEFINITIONS

Authorisation – the electronic verification process of the Card data initiated by the Merchant for requesting the Issuer’s authorisation to perform a Transaction.

Price List – a valid list of commission fees available at the place of purchase of the Gift Cards at the Representative’s Information Centre and on the Representative’s website viajurmala.com.

Transaction – a financial action initiated by the Merchant within which the User makes a payment for a purchase or a service by using the electronic money issued by the Issuer and available on the Card account by using the Card.

Gift Card, Card – an electronic gift card of the brand MasterCard issued by the Issuer and being anonymous means of payment bearing a unique number and intended for execution of Transactions, in particular, paying for goods and services at the Merchants’ points of sale in the Shopping Centre „VIA JURMALA OUTLET VILLAGE” by using the electronic money issued by the Issuer. Cards can be of different designs.

Gift Card Contract – a set of documents governing the rights and obligations of the Buyer, User, Issuer and Representative in the course of issuing electronic money, issuing, selling, servicing and using the Gift Card. The Gift Card Contract consists of the Terms, the Price List and the Issuer’s Terms of Use of Pre-paid Gift Cards.

Term of Use – the term during which the Card may be used for paying for goods and services and which is stated on the Card.

Issuer – the Limited Liability Company „Transact Pro”, Unified Registration Number 41503033127, Registered Address: Kr. Valdemāra iela 62, Riga, LV-1013, Latvia, website: www.transactpro.lv, a licenced electronic money institution possessing the right to provide payment services, registered with the Register of Licences of the Finance and Capital Market Commission under No. 06.12.04.416/359 and supervised by the Finance and Capital Market Commission. The Issuer issues electronic money, produces and issues the Gift Cards, provides settlements for Transactions and performs other activities provided for by the Terms.

Terms of use of the Issuer’s Pre-paid Gift Cards – the terms approved by the Issuer and applicable to the Cards, as far as they do not contradict the present Terms, available electronically on the Issuer’s website www.transactpro.lv and as a hard copy at the Issuer’s office and the Representative’s Information Centre.

Card Activation – an operation initiated by the Representative’s authorised person at the moment of purchase of the Card and during which the Term of Use and the Nominal Value is assigned to the Card. The Card is valid for use as from the moment of its purchase.

Loss of the Card – loss or theft of the Card.

Commission Fee – the fee for the services received in relation to the Card; it is defined according to the valid Price List.

User – a natural entity who uses the Card for execution of Transactions and whose signature sample is on the Card.

Nominal Value – the value in the EUR currency stated on the Card, which is paid by the Buyer at the moment of purchase of the Card to the Representative and which is equivalent to the amount of electronic money on the Card Account.

Terms – the present Terms of Use of the Gift Cards of the „VIA JURMALA OUTLET VILLAGE” which are binding for the Issuer, Buyers and Users.

Representative – the entity authorised by the Issuer distributing the Cards on the Issuer’s behalf at the Information Centre and representing the Issuer in relations with the Buyers and the Users.

PIN code – a combination of four digits – 1234, which is used by the User in confirming Transactions executed by presenting the Card and also in checking the Card Account balance in the ATM.

Buyer – a natural or legal entity who buys the Card (-s).

Shopping Centre „VIA JURMALA OUTLET VILLAGE” – the centre where there are sales points and service points of Merchants and which is located at Jaunā iela 12, Piņķi, Babīte, Jūrmala; website address: www.viajurmala.com

„VIA JURMALA OUTLET VILLAGE” Information Centre or Information Centre – the place of selling the Cards within the Shopping Centre “VIA JURMALA OUTLET VILLAGE” where it is possible to buy the Gift Card and to perform other activities provided for by the Terms.

Merchant – a legal entity who has signed the Contract on the Lease of Premises with the Representative and who accepts the Card as payment for Transactions.

2. GENERAL PROVISIONS

2.1. The Card is anonymous, the Buyer’s or the User’s name and surname or title is not stated on it.

2.2. The card has a limited Term of Use which does not exceed 12 (twelve) months as from the date of activation of the Card (the purchase date).

2.3. The allowed minimum and maximum Nominal Value of the Card is restricted and it may not be below the amount of electronic money equivalent to EUR 10.00 (ten euro) or above the amount of electronic money equivalent to EUR 150.00 (one hundred and fifty euro).

2.4. The Card can only be used for settlements in the Merchants’ points of sale and points of service located within the Shopping Centre „VIA JURMALA OUTLET VILLAGE” where the payment cards of the brand MasterCard are accepted for settlements.

2.5. The Card may be used for execution of several Transactions within the scope of its Term of Use and Nominal Value.

3. PURCHASE OF CARDS

3.1. Cards can be bought at the Information Centre. The Cards can be purchased by both natural and legal entities.

3.2. At the moment of purchase of the Card the Buyer shall make the payment of the full amount equal to the Nominal Value of the Card and shall pay the fee of issue of the Card if this is provided for. The payment shall be made in cash or by a payment card. Gift Cards of the total value of EUR 400.00 (four hundred euro) can be bought by paying cash; if Gift Cards for a higher total nominal value are bought, payments exceeding the above referred amount shall be made by another payment card or by a bank transfer. The payment for the Card cannot be made by other gift cards, cheques, etc.

3.3. The Buyer chooses the Nominal Value of the Card at the moment of purchase by taking into account Clause 2.3 of the Terms.

3.4. Following payment of the Nominal Value of the Card, the Card is activated. Activation of the Card is completed at the moment when the Representative prints out the cash register receipt confirming the transaction. The Card with its Nominal Value printed on it is issued to the Buyer. The purchase receipt and the Card credit receipt is issued to the Buyer together with the Card in compliance with the procedure defined by the legislation of the Republic of Latvia.

3.5. The provisions of Section 5 of the Terms are applicable to legal and natural entities who want to buy Cards by making a bank transfer.

3.6. The Buyer shall verify the Nominal Value defined on the Card and on the Card credit receipt and that the Card is not damaged immediately following receipt of the Card. If the Buyer finds non-compliances, he/ she shall immediately notify the Representative thereof. If there is a dispute regarding the Nominal Value, the amount of the Nominal Value stated on the Card purchase and the Card credit receipt shall prevail. If the Buyer cannot present a relevant receipt, the amount of electronic money equal to the amount of money found based on the data of the cash register of the Information Centre having issued the relevant receipt is considered the Nominal Value.

3.7. The Buyer shall maintain the cash receipt confirming the transaction and the Card credit receipt which is the only proof of purchase of the Card. It has to be presented in case of loss of the Gift Card.

3.8. Purchase of the Card is an attestation that the Buyer has familiarised itself with the Terms, the Price List and fully agrees to them, enters into the tacit Gift Card Contract with the Issuer represented by the Representative who accepted the Buyer’s application for purchase of the Gift Card. The Terms and the Price List are binding for the Buyer as from the moment of purchase of the Gift Card.

4. RESTRICTION OF PURCHASE OF THE CARD

4.1. The Purchaser can buy the Gift Cards for the total amount of the Nominal Values not exceeding the equivalent of EUR 150.00 (One hundred and fifty euro) in compliance with the restrictions of the Nominal Value of the Card defined by Clause 2.3 at one instance without personal identification.

4.2. Cards with a higher total amount of the Nominal Values can be purchased in compliance with the procedure defined by Clause 5 of the Terms by performing the Buyer’s identification in compliance with the Issuer’s customer.

4.3. The Issuer and/ or the Representative are entitled to reject issuing of the Gift Cards to the Buyer if there is suspicion regarding a money laundering attempt and in other situations provided for by other regulatory enactments or the present Terms.

5. PURCHASE OF THE CARDS IN WHOLESALE

5.1. Legal or natural entities who would like to buy the Cards for the total amount of the Nominal Values exceeding EUR 150.00 (hereinafter referred to as the Wholesale Buyer) shall approach the Representative’s administration and sign the individual Gift Card Purchase Contract by filling in an application defining the purpose of purchase of the Gift Cards and obliging the Buyer to register further transfer of the Gift Cards to the User.

5.2. If the Wholesale Buyer would like to order and to buy Cards by a bank transfer, an invoice is sent to the Wholesale Buyer following signing of the Gift Card Purchase Contract.

5.3. The Wholesale Buyer is obliged to settle the above invoice within 10 (ten) days as from the date of its issue. If the payment is not done within the set term, this order is not binding for the Representative or the Issuer.

5.4. The Representative prepares the Cards and notifies the Buyer about the possibility to receive the ordered cards within 5 (five) business days following settlement of the above invoice in full amount.

5.5. If the Wholesale Buyer buys the Cards by a bank transfer and the number of the purchased Cards exceeds 20 pcs and/ or the total amount of the Nominal Values of the Cards exceeds EUR 2000.00, the Wholesale Buyer’s authorised representative receives the ordered Cards at the Information Centre with an attached delivery note by submitting a document attesting the authority.

5.6. The Wholesale Buyer’s authorised representative verifies the number of received Cards, the Nominal Values defined on the Cards and in the delivery note and also checks if the Cards are not visibly damaged immediately at the moment of receipt of the Cards. Upon finding non-compliances they shall be immediately reported to the employee of the Information Centre. Following issue of the Cards to the Wholesale Buyer’s authorised representative, no complaints regarding compliance of the number of the Cards and their Nominal Values with the order and regarding the condition of the Cards are accepted.

6. BUYER’S IDENTIFICATION

Prior to issue of the Gift Card to the Buyer, the Issuer and/ or Representative is entitled to perform the Buyer’s identification in compliance with the procedures defined by the regulatory enactments and the Issuer’s customer identification procedure and to reject issue of the Gift Card if the Buyer’s identification is not possible.

7. RIGHTS AND OBLIGATIONS OF THE BUYER AND THE USER

7.1. The Buyer is entitled to transfer the Card for use to any third party – the User – or to use it by itself. The Buyer is obliged to present the Terms, the Price List and other information applicable to the Cards to the User upon transfer of the Card to the User. The User is also entitled to transfer the Card to other Users without any restriction by performing the Buyer’s actions provided for by the present Clause.

7.2. The User obtains all the User’s rights and obligations as from the moment of receipt and signing of the Card.

7.3. The Buyer/ User is entitled to make payments with the Card at the Merchants without any restrictions during its Validity Term and as long as the total amount of Transactions and Commission Fees does not exceed the Nominal Value of the Card.

7.4. The Buyer is entitled to return damaged Cards to the Representative in compliance with the Terms. The Cards are only replaced when the damaged Card is submitted and it does not possess the features of falsification.

7.5. The Buyer has familiarised itself with the legislation of the Republic of Latvia regarding money laundering and is aware that the Representative, the Merchant or the Issuer is entitled to report to the responsible authoritiesand is entitled to require identification of the Buyer and/ or the User in cases when the Representative, the Merchant or the Issuer have the grounds to consider that the Buyer and/ or the User plans to execute or has executed a suspicious or unusual financial transaction.

7.6. The Buyer and/ or User assumes all the risks of losing or possible destroying of the Card as from the moment when the Card is issued to the Buyer and/ or User in compliance with the present Terms. In case of the loss of the Card when there is a risk of unauthorised use of the Card, the relevant Card is blocked when the Buyer and/ or the User applies for blocking of the Card by calling the telephone number 67222 555 and submitting also a written application as soon as possible. All the risks of possible unauthorised Transactions with the Card until the moment of blocking it are assumed by the User and/ or Buyer; the Issuer is not responsible for unauthorised Transactions executed with the Card the Nominal Value of which does not exceed EUR 150.00 (one hundred and fifty euro). When the Card is blocked it is necessary to provide the name, surname, contacts, the Card number (or the part which can be seen on the receipt confirming purchase of the Card).

7.7. The User and/ or Buyer is entitled to claim replacement of a lost or stolen card with a new Card with the electronic money balance of the stolen or lost Card if the conditions referred to in Clause 7.6 are complied with, the User and/ or the Buyer has submitted the application for replacement of the Card by presenting the receipt of purchase of the Card and paying the Commission Fee for replacement of the Card (its equivalent may be deducted from the balance of the electronic money of the Card). The Issuer is entitled to refuse replacement of the Card if the information specified by the Card User and/ or Buyer is non-compliant or the Card balance has been used until its blocking.

8. PURCHASES BY THE CARD

8.1. The Card can be used for Transactions immediately following its purchase and activation of the Card.

8.2. The User shall sign the Card prior to making purchases with the Card.

8.3. Purchases are made with the Card by presenting the Card to the Merchant’s employee prior to executing the Transaction.

8.4. In order to make the Transaction, the Merchant’s employee initiates the Card Authorisation.

8.5. If the Authorisation is successful, the electronic money equivalent to the purchase amount is debited from the Card account and the User receives the cash register and the POS terminal receipt confirming the Transaction. The User is obliged to sign one counterpart of the POS terminal receipt and to return it to the Merchant’s employee and to maintain the other counterpart for the case when the Issuer requests it for taking a decision regarding the complaints reported by the Buyer and/ or User.

8.6. If the Authorisation is not successful because:

8.6.1. the balance on the Card account is not sufficient for executing the Transaction, the User is entitled to pay the difference by another Card, in cash or by a bank payment card if the Merchant provides for this option;

8.6.2. the Term of Use of the Card has expired, in this case the User is entitled to submit an application for restoring the Card in compliance with the present Terms by paying the Commission Fee;

8.6.3. the Card is damaged, in this case the User is entitled to submit an application for replacement of the Card in compliance with the present Terms;

8.6.4. telecommunication services are not provided or there are other technical problems, in this case the User shall pay for the particular goods or services by using other mans of payment if this is possible. If the above unsuccessful purchase attempt is takes place on the last date of the Term of Use of the Card, the User is entitled to claim extension of the Term of Use of the Card for minimum one day without paying the Commission Fee.

8.7. The Merchant may refuse accepting the Card for execution of the Transaction if the Card account balance is equal to EUR 0.00 (zero euro), its Term of Use has expired, it is damaged or the Authorisation was rejected due to reporting the Card as stolen or lost.

8.8. The Merchant may refuse accepting the Card for execution of the Transaction if the employee suspects that the Card is falsified or the security parameters of the Card do not comply with the terms of the international payment systems. If there is such suspicion, the Merchant may withhold the Card. Withheld cards are transferred to the Issuer for adopting the decision on further action with them.

8.9. If any Merchant does not accept the Card for payment for goods or services or if the User has grounded suspicion that the Merchant reads the Card data several times without a need thereof or performs other suspicions actions with the Card, or rejects execution of the Transaction with the Card without a grounded reason thereof, the User is obliged to notify the representative of the Information Centre and/ or the Issuer thereof immediately and to submit a written explanation upon request by recording the situation and all the circumstances. If the User does not follow the provision of the above Clause of the Terms as regards the obligation to notify a possible or established non-compliance action of the Merchant, the data of the Issuer’s Card processing system regarding the Transaction will be deemed a justified proof of the fact of the Transaction, including the amount of the Transaction.

8.10. If the Transaction is cancelled due to any reason (for example, in the cases provided by the Law on Protection of the Consumer Rights), the Merchant repays the Transaction amount or a part thereof to the User in compliance with the procedure of cancelling Transactions defined by the Merchant.

8.11. The Representative may define particular Merchants whose goods or services cannot be paid by the Card. If such restrictions are imposed information about them is visibly placed at the Information Centre and at the particular Merchant. The User is entitled to assure whether non-acceptance of the Cards is an initiative of the particular Merchant (and thus non-compliant with the present Terms) or defined by the Representative at any moment at the Information Centre.

9. COMMISSION FEES

9.1. The Commission Fees defined by the Price List are applicable for the issue of the Card and its use. No annual fee is applicable to the Cards. Separate fee for issue of electronic money is not applicable to the Cards.

9.2. Commission Fees are provided for additional services provided upon the Buyer’s or the User’s request, for example, including, but not limited to restoration of the Card, replacement of the damaged Card, viewing the Card account balance at the ATM, etc.

9.3. The Issuer is entitled to alter the Commission Fees unilaterally by ensuring their publication on the Representative’s website and placement of the Price List at the Information Centre.

9.4. The Commission Fees are payable in cash or by a bank payment card prior to receipt of the relevant service. The Commission Fee may be withheld from the Card account balance by the Issuer writing off electronic cash from the Card account in the amount equal to the payable Commission Fee and reducing the amount of the User’s claim to the Issuer for repurchase of electronic money if the Card account balance is sufficient for payment of the Commission Fee.

9.5. Following expire of the Term of Use, the Commission Fee for maintenance of the Card account will be applicable to the Card with the electronic cash balance not equal to 0.00 until the last business day of very month, until the electronic money balance on the Card account is equal to 0.00 and the Card account is closed.

10. REPORTS ON TRANSACTIONS WITH THE CARD

10.1. The User can request a report on all the Transactions executed by the Card at the Information Centre by filling in an application. The User receives an answer within 5 (five) business days.

10.2. The User can receive information about the Card balance free of charge at the Information Centre; at any time of the day (except breaks due to technical reasons) on the Issuer’s or the Representative’s website by entering the Card number, or by calling the telephone number 67222 555 and providing the Card number; for a fee equal to the Commission Fee defined by the Price List at any ATM bearing the logo of MasterCard by inserting the Card and entering the PIN code.

10.3. The information specified in Clauses 10.1 and 10.2 of the Terms is available during the Term of Use of the Card and minimum 1.5 years following the date of expire of the Term of Use at the Information Centre and the Issuer.

10.4. The reports and information referred to in Clauses 10.1 and 10.2 are prepared electronically and are valid without a signature and a stamp.

11. SUPPLEMENTING THE CARDS

11.1. The Nominal Value of the Card is set at the moment of activation and it cannot be increased or supplemented following purchase of the Card.

11.2. Balances of several Cards cannot be merged.

12. TERM OF USE OF THE CARDS, INVALID AND FALSE CARDS

12.1. The Term of Use of the Card is printed on the Card. The Card is valid until the last date of the month stated on the Card (inclusive) within the framework of the working hours of the Representative and/ or the relevant Merchant.

12.2. The Card is not valid if:

12.2.1. its electronic money balance is equal to 0.00 (zero); or

12.2.2. its Term of Use has expired; or

12.2.3. it is damaged (the Card is deemed to be damaged if its magnetic strip cannot be read or it has mechanical damage, the card number, the Nominal Value or the validity term is not visible); or

12.2.4. it is falsified or possesses the features of falsification.

12.3. The Card is deemed to be falsified if its electronic money balance exceeds the amount equivalent to EUR 150.00 (one hundred and fifty euro), its look/ design does not comply with the Card sample defined by the Representative or it possesses other features of falsification described in the Issuer’s Terms of Use of Pre-paid Gift Cards.

12.4. Falsified Cards are cancelled, they cannot be replaced with valid Cards and their balance is not repurchased and its equivalent in the euro currency is not paid to the User.

12.5. In cases defined by Clauses 12.2.2 and 12.2.3 of the Terms the Card can be replaced by a new one by submitting a relevant application to the Information Centre and paying the Commission Fee.

13. RESTORATION OR REPLACEMENT OF THE CARDS

13.1. The Term of Use of the Card can be restored once during a period of 3 (three) months following expire of the Term of Use of the Card by paying the Commission Fee. A new Card with the same balance as the replaced Card had and the term of use of 6 (six) months is issued to the User as a replacement of the replaced Card. The User returns the replaced Card to the Information Centre.

13.2. A mechanically damaged Card which cannot be used for settlements can be replaced with a new Card with the Nominal Value not exceeding the balance of the replaced Card.

13.3. In cases referred to in Clauses 13.1 and 13.2 of the Terms the User shall act as follows:

13.3.1. the Card User’s application shall be filled in at the Information Centre;

13.3.2. the User who submits the application shall state his/ her contact information to enable the representative of the Representative or the Issuer to contact the User in case of questions regarding the application;

13.3.3. the Issuer reviews the application within 2 (two) business days of the Issuer (all the days except Saturdays and Sundays, the official holidays of the Republic of Latvia, as well as the additional holidays set by the Issuer the information regarding which is available on the Issuer’s website as from the date when the Issuer has received the relevant application;

13.3.4. following adoption of the decision the representative of the Representative or the Issuer contacts the User who submitted the application and agrees on the procedure of replacement of the Card or notifies the refusal to replace the Card.

13.4. A damaged Card is not replaced with a new Card if features of falsification are found.

13.5. Damaged Cards are replaced with new Cards at the Information Centre by submitting the damaged Card, paying the Commission Fee and presenting a document confirming purchase of the Card.

14. REPURCHASE OF ELECTRONIC MONEY AND RECEIPT OF THE CARD BALANCE

14.1. During the Term of Use of the Card and 3 (three) years after the expire of the Term of Use, the User is entitled to submit a request to the Issuer to repurchase electronic money on the Card account and payment of the Card balance by bank transfer to the Information Centre. The User fills in a template of a particular form, submits the Card to the Information Centre, presents a document confirming purchase of the Card and the User’s Identification document upon request and also pays the Commission Fee. The Card Balance is not paid if it does not exceed the amount of the Commission Fee, if the Card is not submitted, if any features of falsification of the Card are found, if it is blocked or damaged.

14.2. Repurchase of electronic money and payment of the Card balance may be claimed and received only once and only in the full amount of the Card balance (after deduction of the relevant commission fees specified by the Price List); repurchase of electronic money on the Card account in parts is not possible. Following payment of the balance the Card is cancelled, the Card account is closed and the Card cannot be longer used.

14.3. Following expire of the term defined by Clause 14.1 of the Terms, the User loses the right of claim against the Issuer regarding repurchase of the balance of electronic money on the Card account; the electronic money balance is closed and its cash equivalent is no longer paid out.

15. COMPLAINTS

15.1. The Buyer and the User are entitled to submit any complaints regarding the purchase of the Card and Transactions with the Card in compliance with the term and procedure defined by the Terms of Use of Pre-paid Gift Cards of the Issuer.

15.2. Complaints may be submitted to the Information Centre and also to the Issuer.

15.3. Complaints shall be submitted in writing by specifying the name, surname, Personal ID Code and contact information of the entity submitting the complaint, the Card number, the transaction or the data disputed by the entity submitting the complaint, the facts and the conditions justifying the complaint and the claim of the entity submitting the complaint.

15.4. Complaints regarding Transactions are reviewed and a justified answer regarding the complaint is provided within 45 (forty five) days following their receipt. Complaints of another content related to purchase or use of the Card (complaints where no Transactions are doubted) are reviewed in compliance with the procedure defined by the Issuer’s policy of review of disputes.

15.5. Complaints submitted beyond the term referred to by Clause 15.4 of the Terms or non-compliant with the requirements of Clause 15.3 of the Terms, are not reviewed. In the cases provided for by the Terms, the Card to which the complaint is related shall be attached to the Complaint.

15.6. The Buyer and the User is obliged to check received receipts and cheques immediately following purchase of the Card and performance of the Transaction.

15.7. In case of any non-compliances the data of the system of processing of card transactions used by the Issuer regarding the Transactions and the Card balances will be deemed prevailing.

15.8. If the complaint is declared grounded, the Issuer either restores operation or the balance of the existing Card or issues a new Card with the Nominal Value compliant with the justified reimbursement amount to the entity having submitted the complaint.

15.9. If the complaint is declared ungrounded, the entity having submitted the complaint is obliged to pat the Commission Fee for review of an ungrounded claim according to the Price List. The Issuer is entitled to withhold the Commission Fee from the Card balance by writing off electronic money equal to the amount equal to the Commission fee and reducing the User’s right of claim against the Issuer for the repurchase of electronic money.

16. RIGHTS AND RESPONSIBILITY OF THE ISSUER AND THE REPRESENTATIVE

16.1. The Representative is only responsible for performance of its obligations described by the Terms, the Issuer’s obligations are additionally defined by the Terms of Use of the Pre-paid Gift Cards of the Issuer.

16.2. The Issuer or the Representative is not responsible for the quality, safety or compliance of the goods sold or services provided by the Merchant.

16.3. In any case, the Issuer’s responsibility is limited to the balance amount of the particular Card.

17. RESOLUTION OF DISPUTES AND APPLICABLE LAW

17.1. The Terms shall be interpreted in compliance with the legislation of the Republic of Latvia.

17.2. Any disputes arising between the Issuer, the Representative, the Buyer and the User in relation to the Cards or the Terms, any material or immaterial disagreements or claims arising from the present Terms are heard by the court of the Republic of Latvia.

18. FINAL PROVISIONS

18.1. By making a payment by the Card or by signing the Card purchase contract, the Buyer enters into the Gift Card Purchase Contract and all the provisions of the Gift Card Contract, including the Terms, are binding for the Buyer as from this moment; by the above actions the Buyer confirms that he/ she has got acquainted with the provisions of the Gift Card Contract, agrees to them and undertakes to comply with them.

18.2. The Issuer and its representatives are entitled to process the personal data of the Buyers and the Users, as far as this is necessary for performance of the obligations defined by the Gift Card Contract provisions and applicable regulatory enactments.

Privacy policy

This privacy policy (Privacy Policy) explains how “VIA JURMALA OUTLET VILLAGE”, that is operated by the limited liability company “SIA OUTLETICO”, registration number: 40103979709, registered address: Aleksandra Čaka street 72-1, Rīga, LV-1011 („VIA JURMALA OUTLET VILLAGE”, “we”, “our” and “us”), collects and uses the information from your contact with the “VIA JURMALA OUTLET VILLAGE” products. The present Privacy Policy is applied to all Users (“Users”, “you” and “your”) who use the “VIA JURMALA OUTLET VILLAGE” website and mobile application (all collectively – „VIA JURMALA OUTLET VILLAGE” Sites).

Please carefully read the provisions of this Privacy Policy, as well as contact us, if necessary.

1. User’s Consent

By agreeing to applying this Privacy Policy, the User confirms that he/she is informed about the processing of his/her personal data to the extent and under the procedure outlined in the present Privacy Policy.

2. Personal Data collected by Us

The personal data means the information related to an identifiable or identified natural person. The following information about the User is being compiled:

- Language you use on the “VIA JURMALA OUTLET VILLAGE” Sites;

- Name;

- Age;

- ID number of your device;

- The type of operating system of your device;

- Information about preferred stores;

- Information about categories marked as “liked”.

3. How the Personal Data are collected

We can:

- request personal information upon your registration, subscribing for newsletters, creating an account, or otherwise using the “VIA JURMALA OUTLET VILLAGE” Sites;

- receive additional personal information from third parties (Google Analytics);

- collect information about your location, history of visits, search history, and uploads to the “VIA JURMALA OUTLET VILLAGE” Sites, when you use offers on the “VIA JURMALA OUTLET VILLAGE” Sites through the mobile phone or a different device used to visit the “VIA JURMALA OUTLET VILLAGE” Sites.

- within the consent of the person, we will collect information about the person’s e-mail address if the person has applied for receiving newsletters.

We hereby inform that upon using other third-party services in order to use the “VIA JURMALA OUTLET VILLAGE” Sites, such platforms, applications or services may have their own specific privacy conditions that govern use of the personal information.

4. For What Purposes We use Your Personal Data

“VIA JURMALA OUTLET VILLAGE” uses the personal data for the following purposes:

- to procure operations and improve the “VIA JURMALA OUTLET VILLAGE” Sites, introduce new functions and technologies, based on our legitimate interest to improve the quality of our services;

- to provide user support, based on your consent when you approach us seeking support, as well as our legitimate interest to improve the quality of our services;

- to check and verify the information in the Users’ profiles based on our legitimate interest to identify the particular User;

- for communication (using notifications on the mobile devices) and to provide additional information about “VIA JURMALA OUTLET VILLAGE”, its offers, planned changes, improvements, questionnaires, administrative or other notifications that might be of interest to you based on your consent to receive such communications. Certain communications can be sent based on our legitimate interest to notify you about the news of “VIA JURMALA OUTLET VILLAGE”;

- to keep statistics about the Users, as well as to transfer such statistics to service providers based on our legitimate interest to ensure further development and maintenance of “VIA JURMALA OUTLET VILLAGE”;

- to ensure our day-to-day activities, for example, to administer, maintain, analyze the “VIA JURMALA OUTLET VILLAGE” Sites, prevent fraud or ensure compliance with provisions of the effective laws based on the duty imposed on us to comply with requirements of the provisions of law and necessity to ensure operation and development of the “VIA JURMALA OUTLET VILLAGE” Sites.

5. How long “VIA JURMALA OUTLET VILLAGE” stores your data

We process and store your personal data until the time when you delete your information from the “VIA JURMALA OUTLET VILLAGE”. Sites. However, certain types of personal data may be retained, for instance, statistical data may be retained in a summarized form for us to be able to improve functionality of the “VIA JURMALA OUTLET VILLAGE” Sites.

6. When and Why “VIA JURMALA OUTLET VILLAGE” transfers the personal data

We can transfer your personal data as required or permitted under the effective laws and regulations in line with the following:

- to partners of “VIA JURMALA OUTLET VILLAGE” or advertisers, agencies, including companies representing Facebook, Google Analytics and other brands. The information is being transferred to such extent as required to ensure functionality of the “VIA JURMALA OUTLET VILLAGE” Sites;

- to commence a merger of companies, transfer of undertaking, or another activity related to the operations of “VIA JURMALA OUTLET VILLAGE”.

By using the “VIA JURMALA OUTLET VILLAGE” Sites, you confirm that you are informed that your personal data may be transferred to aforementioned third parties and processed (inter alia, stored, analyzed, registered, modified, used, deleted) in line with the purposes described in the Privacy Policy. However, the use of your personal data may be subject to privacy policies of such persons, which are beyond our control. We can disclose your information, if it cannot be identified with you or in the event that it is necessary in accordance with the effective laws and regulations and/or at a request of government or municipal authorities.

7. Changes in the Privacy Policy

We can update or supplement the present Privacy Policy, if new services are added to the “VIA JURMALA OUTLET VILLAGE” Sites. These supplements or amendments to the Privacy Policy shall come into effect at the time when posted on the “VIA JURMALA OUTLET VILLAGE” website and mobile application and communicated to the Users. The currently valid Privacy Policy is available on the website and mobile application of “VIA JURMALA OUTLET VILLAGE”.

8. Your Rights and Safety of Personal Data

You have the right to access your personal data from your mobile application account, make rectifications therein, update or delete it, as well as receive information and bring claims and objections in accordance with the provisions of effective laws. In order to exercise your rights please contact us using the contact information provided in Paragraph 9 of the Privacy Policy.

You have a right to approach the national data supervisory authority – Data State Inspectorate, Blaumaņa iela 11/13-15, Riga, LV-1011, phone: +371 67223131, email: [email protected]

In order to guarantee the integrity and safety of the processed personal data as well as in order to prevent loss, modification and/or unauthorized access by third parties, “VIA JURMALA OUTLET VILLAGE” has introduced necessary legal and technical measures.

9. More information

Limited liability company “SIA OUTLETICO”. For more information about this Privacy Policy and right of access, please contact us by writing to email address: [email protected]

The Terms are approved and come into effect on 10 December 2018.

Cookie Use Policy

When you use the “VIA JURMALA OUTLET VILLAGE” Sites, we collect, automatically or by electronic means, certain information by using such tools as cookies, browser analytical tools, and web server logs. When you use the “VIA JURMALA OUTLET VILLAGE” Sites and applications, your browser and devices contact our servers and the servers operated by our partners and service providers in order to coordinate and keep record of activities and satisfy your request for services and information.

The information about cookies and related technologies is stored on web server logs, as well as in cookies stored on your computer or mobile devices and afterwards transmitted back to “VIA JURMALA OUTLET VILLAGE” Sites using your computer or mobile devices. These servers and cookies are administered by us, our partners, or Service Providers.

Various types of information are collected from cookies and other technologies that might include:

- Functional cookies used to provide functionality of the services used, such as an option to establish preferences (for instance, language of the browser) or memorize your previous activities. These cookies are used based on our legitimate interest to ensure operation of the “VIA JURMALA OUTLET VILLAGE” Sites and provide services. These cookies are retained until you delete these cookies;

- Analytical and statistical cookies, which are used to optimize our services. So, for instance, we use Google Analytics and other third-party services to optimize performance of our website as well as to analyze how you use our website. We track the internet protocol (IP) address, browser type, browser version, the “VIA JURMALA OUTLET VILLAGE” Sites visited by you, time and date of the visit, time that you have spent on these websites, as well as other statistical data. These cookies are used based on our legitimate interest to compile statistics about use of the “VIA JURMALA OUTLET VILLAGE” Sites and improve their performance. These cookies are retained on your equipment permanently or until you delete them.

You can reject all cookies or give instructions for the browser to report when a cookie is being dispatched. Nonetheless, if you reject the use of cookies you may not have a possibility to use some of the services of “VIA JURMALA OUTLET VILLAGE”.

You can reject the use of Google Analytics cookies by downloading and installing add-on Google Analytics Opt-out Browser Add-on. Google Analytics Opt-out Browser Add-on.

For additional information of general nature regarding cookies and to learn how to manage them please read the information on aboutcookies.org.

For more information about the personal data collected and your right of access please contact us by writing to the following address: [email protected]

Limited Liability Company “SIA OUTLETICO”

The Terms are approved and come into effect on 10 December 2020.

We use cookies for certain functions and analytical purposes. By using our website, you agree to our cookie policy.

For more information:

Limited Liability Company “SIA OUTLETICO”

Registered address: Aleksandra Čaka street 72-1, Rīga, LV-1011, 40103979709

Email: [email protected]

Phone: +371 278 58 791

You have a right to approach the national data supervisory authority – Data State Inspectorate, Blaumaņa street 11/13-15, Riga, LV-1011, phone: +371 67223131, email: [email protected].

Rules of the photography events

Valid from 14.12.2020.

This policy on event photography and filming (Policy) explains how “VIA JURMALA OUTLET VILLAGE” operated by limited liability company “SIA OUTLETICO”, registration number: 40103979709, registered address: Aleksandra Čaka street 72-1, Rīga, LV-1011, as the data controller (“VIA JURMALA OUTLET VILLAGE”, “we”, “our”, and “us”), carries out data processing with regard to reporting on the events held in “VIA JURMALA OUTLET VILLAGE” territory by taking photos and videos.

Please carefully read the provisions of this Policy, and, if necessary, contact us.

1. Data obtained

Upon taking photos and videos of the events held in the territory of “VIA JURMALA OUTLET VILLAGE” the following personal information about you is obtained:

- – your image;

- – date and time of the photo/video recording;

- – your location.

2. Purposes of taking photos and videos of events

Photos and videos of events held in the territory of “VIA JURMALA OUTLET VILLAGE” are taken for the purpose of reporting about the course of the events in mass media and social media, on the basis of legitimate interests of “VIA JURMALA OUTLET VILLAGE” to report and promote the organized events and the “VIA JURMALA OUTLET VILLAGE” brand.

3. How long “VIA JURMALA OUTLET VILLAGE” stores your data

We store the photos and videos of events organised in the territory of “VIA JURMALA OUTLET VILLAGE” for 5 (five) years after the date when the specific event was held in order to report about and promote the events organised by “VIA JURMALA OUTLET VILLAGE” thus facilitating recognizability of the “VIA JURMALA OUTLET VILLAGE” brand.

Part of the images, such as images showing the hosts of the events, invited persons and panorama views, may be stored on permanent basis for the purposes described above.

4. Who has access to photos and video recordings

Our employees and photography and filming service providers have access to photos and video recordings of the events organised by “VIA JURMALA OUTLET VILLAGE” . Certain photos or videos may be posted on mass media, social media, or placed in the territory of ““VIA JURMALA OUTLET VILLAGE” , where they are available to an unlimited number of people.

Upon request, having assessed the substantiation, or in accordance with provisions of the law, the photos and videos may be handed over to the government or municipal authorities.

5. Your rights and safety of personal data

You have a right to access your personal data, make corrections thereto, renew or erase it, as well as receive information and bring claims and objections in accordance with provisions of the effective laws and regulations. In order to exercise your rights please contact us through the contact information specified in Paragraph 6 of the Policy.

If you do not wish to be photographed and/or filmed certain areas at the venue of the event are designated where no photos and videos are taken.

Please bear in mind that in order to exercise the right granted to you in the area of the personal data protection, you have to submit a signed application in person, at the “VIA JURMALA OUTLET VILLAGE” administration office, or send an application signed electronically to the e-mail address of “VIA JURMALA OUTLET VILLAGE” specified in Paragraph 6 of the Policy.

You also have a right to approach the national data protection authority – Data State Inspectorate at Blaumaņa iela 11/13-15, Riga, LV-1011, phone: +371 67223131, e-mail: [email protected]

In order to guarantee integrity and safeguarding of the personal data, and in order to prevent loss, modification of this data and/or unauthorised access thereto by third parties, “VIA JURMALA OUTLET VILLAGE” has introduced the necessary legal and technical solutions.

6. Contact information

Limited liability company “SIA OUTLETICO”

Registered address: Aleksandra Čaka street 72-1, Rīga, LV-1011

E-mail: [email protected]

Phone: +371 278 58 791

To receive more detailed information about the present Policy and right of access please contact us via e-mail address: [email protected]

7. Changes in the Policy

If necessary, we can update or amend the present Policy. Such updates or amendments to the Policy shall come into effect at the time when posted on the “VIA JURMALA OUTLET VILLAGE” website. The currently effective Policy is available on the “VIA JURMALA OUTLET VILLAGE” website and at the “VIA JURMALA OUTLET VILLAGE” administration office.

The Policy is approved and comes into effect on 10 December 2020

Video surveillance policy

Valid from 14.12.2020.

This video surveillance policy (CCTV Policy) explains how “VIA JURMALA OUTLET VILLAGE” operated by limited liability company “SIA OUTLETICO”, registration number: 40103979709, registered address: Aleksandra Čaka street 72-1, Rīga, LV-1011, as the data controller (“VIA JURMALA OUTLET VILLAGE”, “we”, “our”, and “us”), performs video surveillance in the territory of “VIA JURMALA OUTLET VILLAGE”.

Please carefully read provisions of this CCTV Policy, and, if necessary, contact us.

1. Data obtained

Upon performing video surveillance, the following personal information about you is obtained:

- – your image;

- – date and time of the video (CCTV) recording;

- – your location.

2. Purposes of the video surveillance

Video surveillance in the territory of “VIA JURMALA OUTLET VILLAGE” is carried out for the following purposes:

- prevent and detect criminal offenses on the basis of the legitimate interests of “VIA JURMALA OUTLET VILLAGE” to protect its property and your vital interests;

- compile statistics about the number of visitors of “VIA JURMALA OUTLET VILLAGE” on the basis of the legitimate interest of “VIA JURMALA OUTLET VILLAGE” to make prognosis of the human traffic.

Within the scope of the purpose to compile statistics, the information about the number and traffic of visitors in “VIA JURMALA OUTLET VILLAGE” is collected and processed only in a compiled manner.

3. How long “VIA JURMALA OUTLET VILLAGE” stores your data

We process and store the video surveillance materials no longer than for 25 (twenty-five) to 30(thirty) days, taking into account the location where the specific CCTV camera is placed. If the video surveillance material is necessary for further investigation or as proof of a criminal offense, it can be stored throughout the period of investigation and, in relevant cases, stored in an archive along with the materials of the investigation file no longer than 10 (ten) years.

4. Who has access to the video surveillance materials

The access to the video surveillance materials is strictly limited and provided only to those persons who require it for the performance of their employment obligations. We ensure that only administration staff of “VIA JURMALA OUTLET VILLAGE” and employees of the security services provider have access to the video surveillance materials.

You can access the video surveillance materials upon request, specifying the particular time when you were in the territory of “VIA JURMALA OUTLET VILLAGE” and particular place where you were.

Upon request, having assessed the substantiation, or in accordance with provisions of the law, the video surveillance materials may be handed over to the government or municipal authorities.

5. Your rights and safety of personal data

You have a right to access your personal data, make corrections thereto, renew or erase it, as well as receive information and bring claims and objections in accordance with provisions of the effective laws and regulations. In order to exercise your rights please contact us through the contact information specified in Paragraph 6 of the CCTV Policy.

Please bear in mind that in order to exercise the right granted to you in the area of the personal data protection, you have to submit a signed application in person, at the “VIA JURMALA OUTLET VILLAGE” administration office, or send an application signed electronically to the e-mail address of “VIA JURMALA OUTLET VILLAGE” specified in Paragraph 6 of the CCTV Policy.

You also have a right to approach the national data protection authority – Data State Inspectorate at Blaumaņa iela 11/13-15, Riga, LV-1011, phone: +371 67223131, e-mail: [email protected]

In order to guarantee integrity and safeguarding of the personal data, and in order to prevent loss, modification of this data and/or unauthorised access thereto by third parties, “VIA JURMALA OUTLET VILLAGE” has introduced the necessary legal and technical solutions.

6. Contact information

Limited liability company “SIA OUTLETICO”

Registered address: Aleksandra Čaka street 72-1, Rīga, LV-1011

E-mail: [email protected]

Phone: +371 278 58 791

To receive more detailed information about the present CCTV Policy and right of access please contact us via e-mail address: [email protected]

7. Changes in the CCTV Policy

If necessary, we can update or amend the present CCTV Policy. Such updates or amendments to the CCTV Policy shall come into effect at the time when posted on the “VIA JURMALA OUTLET VILLAGE” website. The currently effective CCTV Policy is available on the “VIA JURMALA OUTLET VILLAGE” website and “VIA JURMALA OUTLET VILLAGE” administration office.

The regulation is approved and comes into effect on 10 December 2020.

Service Pricelist for the Electronic Gift Cards

„VIA JURMALA OUTLET VILLAGE”

| Service | Amount of commission fee1 |

|---|---|

| Card issuance | Free of charge |

| Commission fee for purchases | Free of charge |

| Obtaining information on the Card account’s balance at t/c “VIA JURMALA OUTLET VILLAGE” Information Centres, by phone or online | Free of charge |

| Obtaining information on the Card account’s balance in ATMs (available in Latvia only) | EUR 0.75 |

| Renewal or replacement of the Card | EUR 7.50 |

| Maintenance of the Card account after the expiry of the Card Usage Period | EUR 2.00 per month, until the balance of the account reaches EUR 0.00 |

| Examination of an unsubstantiated claim | EUR 20.00 |

| Cash disbursement | Not applicable |

| Issuance of the Card account statement2 | EUR 2.00 |

| Requesting documents that support the transaction from the Trade | EUR 15.00 |

| Redemption of electronic money, disbursement of the Card balance and closing the Card account3 | EUR 10.00 |

| Transfer to the User’s account opened with:

– Transact Pro; – other financial institution in Europe |

Free of charge EUR 3.00 |

Notes:

1 – VAT is not applied in accordance with Section 52(1)(21) of the Value Added Tax Law.

2 – Commission fee is applied if the account statement is requested more often than once a month or it is requested after the expiry of the Card Usage Period.

3 – Commission fee is not applied if redemption of electronic money or disbursement of the Card balance is requested within one year after the expiry of the Card Usage Period.

Check Your Balance

Please indicate Gift card number to see the balance. You need to wait 30 minutes after last purchase to see exact balance.